It seems scammers have begun to use digital payment apps like Venmo to perpetrate frauds online—and customers should be aware of the common tricks employed to scam them out of their money.

While apps like Venmo, Cash App, and Zelle have made it easy-peasy to exchange money online, it’s also become easy for fraudsters to use the apps in their moneymaking schemes. We’ve gathered some of the most common tricks employed by scammers supposedly in the name of Venmo.

Watch Out For These Common 'Venmo' Scams

Unfortunately, there are a wide variety of tricks being used by scammers to try and steal not only money, but personal information, via customers' trust in the Venmo app.

Venmo, which began life back in 2009 as an SMS-based tool for sending money to contacts without cash or checks, is now a part of PayPal and one of the most popular financial apps out there, allowing customers to send and receive funds easily and free of charge via a connected bank account.

This simplicity of use, however, also makes it an easy target of scammers, who have been trying to use the app to swindle customers out of their money and data.

One way this has been done is through phishing pages sent via unsolicited text, email, or the Venmo app itself from a user looking to be an "official" Venmo account. The message will usually tell the customer that they have won some kind of prize, and need to enter personal information, login details, or make a "test payment" to receive their winnings.

Dear @venmo scammer... I'm savvy enough to know NOT to pay to verify! pic.twitter.com/7ZDRca0WIi

— Kim Avery (@KimAvery17) December 27, 2022

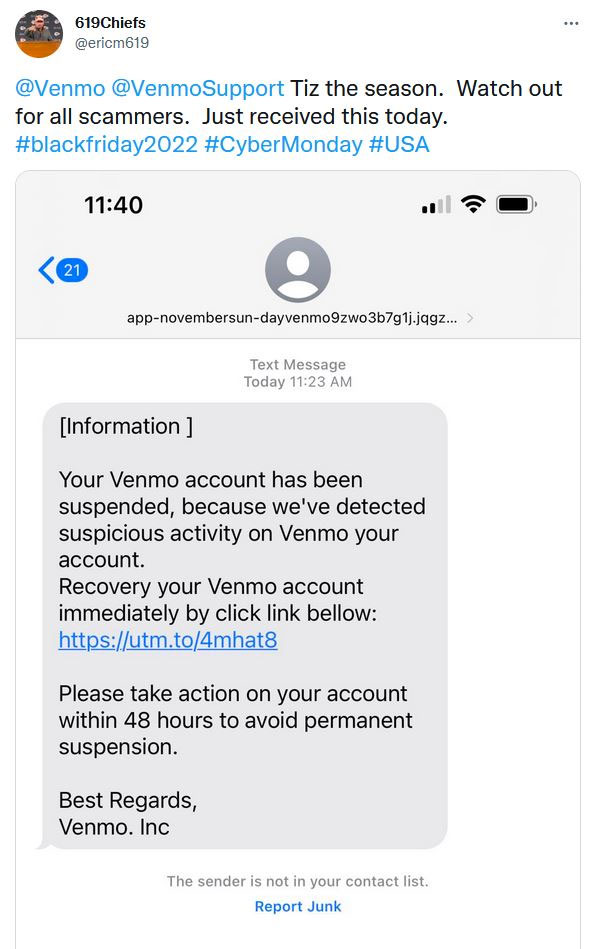

A similar phishing scam comes via text or email, in which a user is told their Venmo account has been suspended, and are directed to recover their accounts via an attached link. The link might look legit, but it's another classic phishing scam where a customer will end up putting personal information right in the hands of fraudsters.

Another tactic comes in the guise of a payment error, also via the Venmo app. A stranger will appear in the user's notifications saying they accidentally paid them a certain amount of money, and will ask the customer to send the money back. However, the original amount has usually been paid via stolen credit cards, and so when the actual card holder realizes what has happened, a chargeback will be requested and thus the money will disappear from the victim's account.

This is similar to an impersonation money request, wherein it's not a stranger but an apparent friend that makes the payment request. Scammers use a friends' info and profile picture to create a fake account purporting to be a real person, and request payment from the real person's friends.

All of these new TLDs are a blessing to #phishing scams.

Example of @Venmo scam just sent to me faking using a .support URL. See article from @DarkReading for further detail on the risks. https://t.co/f6ackDuKbA pic.twitter.com/Ww6BCKDg0n — Bret Piatt (@bpiatt) May 29, 2023

Venmo Scammers Steal Money, Personal Info From Customers

Unfortunately, phishing scams and fraudulent money requests aren't the only schemes customers should be on the lookout for.

If you're attempting to sell an item online, like at Facebook Marketplace, scammers may use Venmo to trick you into believing a payment has been made by sending a fake screenshot that seemingly confirms payment. Or, a payment may actually be made, but it is done using stolen credit card details, which leads to the money being removed from your account once the card holder gets wind of the situation.

There are also classic romance scams with more creative fraudsters using fake social media profiles to begin a correspondence online and, after weeks of building relationships and trust, request the victim send them money ASAP for a similarly fake emergency. After that, of course, they ghost.

Yes. Beware of scams.

THE SCAM: They'll take ownership of a 600-900k property. List it for 30k and say that they are REInvestors looking to give away a house for dirt cheap. In order to take the deal you must make a cash deposit of 1-3k by Venmo/Cashapp. https://t.co/ZSfzqiV6vp — Hewhorunfades (@hewhorunfades) May 25, 2023

Lastly, in more of a real estate fraud, some scammers will participate in a rental deposit scam where they use images from real listings to create a fake rental listing at a price that is usually far under market rate, which will catch the eye of anyone looking for rentals in the area. Victims of the fraud will then be asked to pay a "holding deposit" for their rental via Venmo before they've even had a chance to tour the place, just to make sure they don't lose out on such a well-priced opportunity. Of course, the money is swindled, and the location is nowhere to be found.

WeLiveSecurity lists the following precautions for those using Venmo:

- Only send and receive money from those you know and trust

- If you receive a strange request from an acquaintance, check with them to make sure the request is legitimate

- Don't click on any links sent in unsolicited texts, emails, or other messages

- Keep your Venmo transactions private (this can be changed in your app settings)

- Choose a strong and unique password for your Venmo account and utilize Two-Factor Authentication.

By staying smart and vigilant, you can likely easily avoid the most common Venmo scams floating around the webisphere today.