Attention, Walmart shoppers: a new criminal scam has been discovered affecting some customers at checkout!

New York police have found credit card skimmers placed by outside scammers installed at 13 (and counting) Central New York Walmarts, meaning that credit card information input at the affected credit card readers could be collected and sent anywhere, according to experts. Keep reading for more information and how to see if your credit card information has been obtained—and how to prevent being scammed.

Credit Card Skimmers Installed At 13 Central New York Walmart Locations

According to Syracuse.com, credit card skimming devices have been found at 13 Central New York Walmart locations, and all seemed to have been secretly installed by the same perpetrators. One device, found at the Fulton, N.Y. Walmart, was wireless and could be accessed remotely. Walmart officials are not releasing the exact store locations, nor answering questions about the situation.

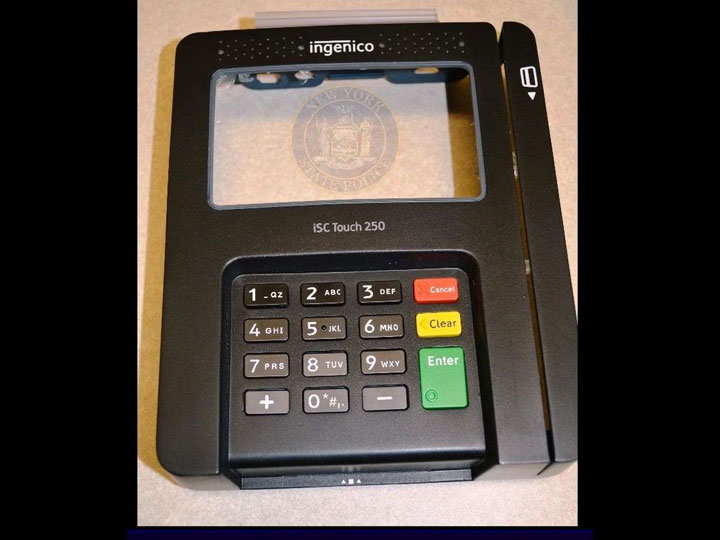

The skimmers covertly installed at the Walmart stores in question look exactly like regular card readers, down to even the name of the company that makes the real items.

In an interview with Syracuse.com, Professor David Weber—who teaches forensic accounting at Salisbury University, and was previously the U.S. Securities and Exchange Commission's chief investigator—shared that there are two main types of credit card skimmers: ones capable of sending information wirelessly to outside devices, and ones that store the information on hard drives that have to be retrieved from the locations later. The ones discovered in Central New York were the wireless kind.

How To Spot And Prevent Fraudulent Credit Card Charges On Your Statements

Credit card skimmers are often installed over credit card readers or sometimes inside ATMs, and collect card information input to readers (like PINs) to use for purchases or to make fraudulent, realistic-looking credit cards. When it comes to PINs, Weber said, "That PIN is the holy grail." Obtaining PINs allows skimmers to make larger purchases that require PIN numbers, as debit cards have less protection from fraudulent purchases. "The existence of the PIN allows an easier and more functional ability to defraud and to defraud larger amounts," Weber said.

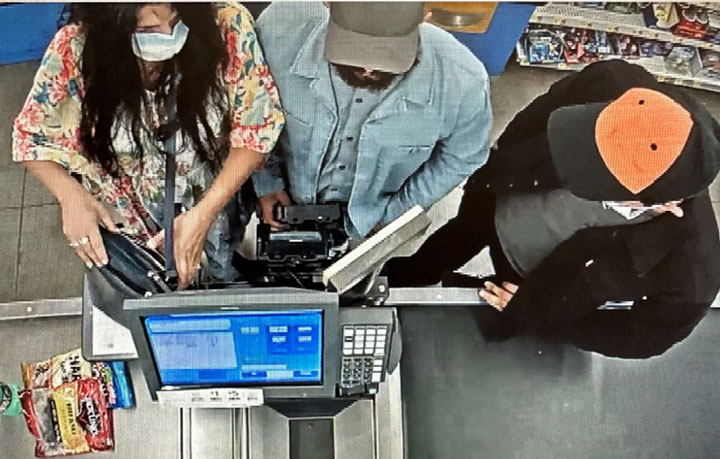

Images of three people suspected of installing the card skimmers were captured by checkout cameras, and have been released to the public in hopes that someone will be able to identify the criminals. Weber stated it is likely that at least one of the three worked at a Walmart at some point: "They’re comfortable with the organization, they know the organization, they’re familiar with the surveillance within the organization."

According to a representative with the F.B.I,'s cyber team, charges from copied cards will appear normal on your bank statements. It is advised that when paying with a credit card at check out, avoid swiping your card and instead use the chip reader. The information from chip payments can be collected by a skimmer, but it's generally more difficult for scammers to collect that data. Best of all is to use Apple Pay, Google Pay, or the tap feature, which the representative says encrypts your card data.

If you are local to the Central New York area and are concerned your credit card information may have been skimmed by these fraudulent readers, you can contact your card provider or the Walmart Customer Care Team, which can be reached at 1-800-925-6278.